Renters Insurance in and around Cypress

Welcome, home & apartment renters of Cypress!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All Cypress Renters!

Think about all the stuff you own, from your entertainment center to dresser to guitar to camping gear. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Welcome, home & apartment renters of Cypress!

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

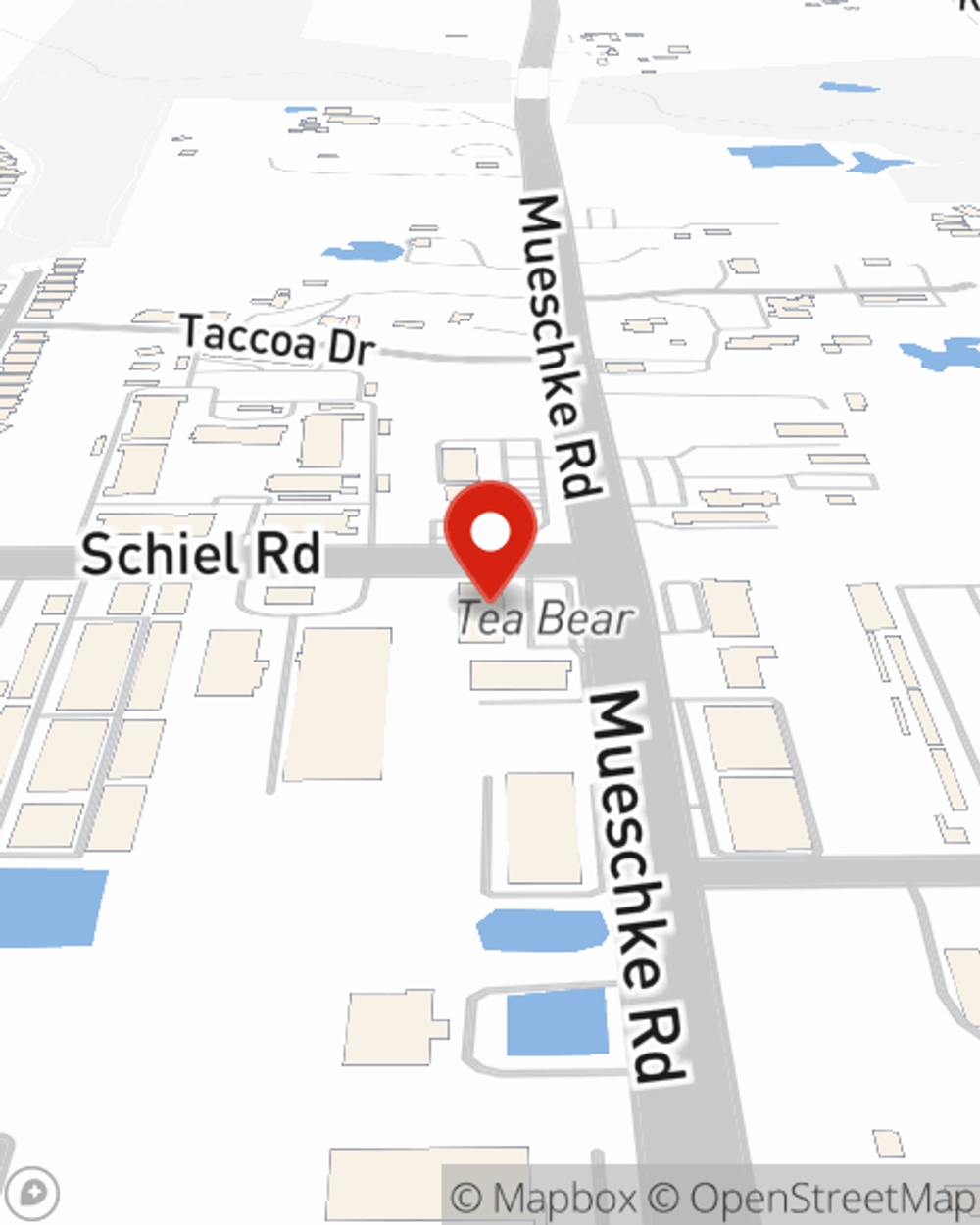

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Kyle Angelle can help you develop a policy for when the unexpected, like a water leak or a fire, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Cypress renters, are you ready to talk about the advantages of choosing State Farm? Contact State Farm Agent Kyle Angelle today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Kyle at (832) 220-1880 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Kyle Angelle

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.